Car Insurance Add-on Covers To Make Your Car Monsoon Ready!

.png)

.png)

Make Your Car Monsoon Ready with Important Car Insurance Add-on Covers in India

Monsoon is the most blissful season as it allows you to get rid of the sultry heat of summer. People all over India eagerly wait for this season so that they can enjoy every drop of rain with scrumptious pakoras and a cup of hot tea/coffee. Though this season gives a smile on everyone’s face; due to the inferior drainage systems, waterlogging is the biggest challenge in many cities. Sometimes due to torrential rain, many streets get clogged and vehicles also break down on the road. This season brings a lot of challenges to car owners as very often garages or parking areas get submerged which causes damage to the engines of the cars. As a car owner, it’s your responsibility to safeguard your vehicle from all monsoon damages. Here we have put together the necessary information related to purchase of car insurance with add-on covers to make your car monsoon-ready.

What Are Car Insurance Add-On Covers?

These days, many car insurance companies are not only selling car insurance online but also offering car insurance add-ons to their customers. This add on coverage in car insurance strengthens the basic policy and also, uplifts the financial security of car owners. Since add ons in car insurance offer extra coverage hence you need to pay an additional premium to utilize these car insurance add on covers. Car insurance add-on covers are only applicable for comprehensive car insurance policies and standalone own-damage car insurance policies. You may not get these add-on covers for third-party insurance policies.

Top Insurance Add-on Covers for Car in India

Let’s take a look at some car insurance add-ons car policies that will help you to deal with various monsoon damages.

1. Engine Protect Cover

This type of add-on cover is one of the utmost essentials in the monsoon season as it reimburses the repair cost of your engine due to various monsoon problems including water penetration, leakage of the lubricant, oil spill, damage to the hydrostatic lock, electrical and mechanical breakdown of the engine and many more. These situations are more prominent when we experience some torrential rainfall. When people need to drive or park their cars through water-logged streets, then the engine of the car stops working suddenly due to failure. Thus, an engine protection cover is quintessential to overcome all the untoward events. This type of cover is one of the smartest investments that a car owner can do to safeguards their car engine especially during the monsoon season.

2. Consumables Cover

To repair your damaged car, you need to invest a lot from your pocket. During the repair process, the car may need various consumables like engine oil, nuts and bolts, lubricant, coolant, and many more. Without car insurance add-on covers, you need to bear the costs of these repair parts. Here enters the consumable cover which offers additional coverage for such costs. Your existing car insurance policy won’t support this type of coverage. While taking your car to the repair center to resolve various monsoon resultant damages, the insurance company will support the customers for the consumable costs. So, in a nutshell, this type of coverage lessens your repair expenditures.

3. Roadside Assistance Cover

This type of cover assists you if your car collapses on the road due to an unknown reason. Vehicles that come up with low ground clearance may get stuck in water-clogged roads due to continuous torrential rainfall. Even high ground clearance cars may get damaged due to heavy rainfall. This type of add-on cover is ideal for you in the monsoon season if a small accident occurs due to rain or if your car gets a flat tyre, or gets stuck in any area. During the rainy season, the possibility of car damage increased manifolds. Thus, this type of add-on cover is highly recommended to car owners.

4. Passenger Cover

The roads become accident prone during the monsoon season. But a normal car insurance policy won’t offer any coverage for the treatment of the passenger due to an accident. Here comes Passenger Cover which offers coverage for healthcare expenses for the passengers of the insured car due to an accident. This type of cover not only provides hospital expenses but also offers ambulance fees. This add-on cover also offers compensation in case of the death or disability of a passenger.

Some More Add-on Covers Which are Beneficial for Your Car or Four Wheeler

No Claim Bonus Protection Cover: Even if you initiate a claim, the NCB Protection Cover safeguards the NCB of car owners. Your premium amount will reduce if you use the NCB protection cover (irrespective of whether you initiated a claim). But, you must remember that this NCB protection cover is only available for own-damage premium car policies. For third-party car insurance policies, the premium amount is decided by the IRDA.

Daily Allowance Cover: Most car owners face various issues during the monsoon season and as a result, they need to give their cars to the network garages for repair. They may need to travel daily by hiring a vehicle or using public transport for their commute. Here comes a Daily Allowance cover that compensates for your day-to-day travel expenses if you gave your insured car to a network garage for repair.

Key Replacement Cover: A normal car insurance policy won’t offer you coverage for key replacement if the key is lost or stolen due to burglary or other unfortunate events. But a Key Replacement Cover offers you all the expenses that you need to bear for replacing the keys of the insured vehicle.

While purchasing a car insurance policy, apart from the aforementioned covers, you may need to consider some add-on covers like a return to invoice cover, tier protection cover, loss of personal belongings cover, etc.

Car Insurance Add-ons are They Really Worth Buying in India?

The above-mentioned add-on covers provide you an additional safety cover for your car in case of various monsoon-related problems that might crop up. So, choose your add-on covers prudently to make your monsoon season free from car related worries.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Other Motor Insurance Products

Latest Post

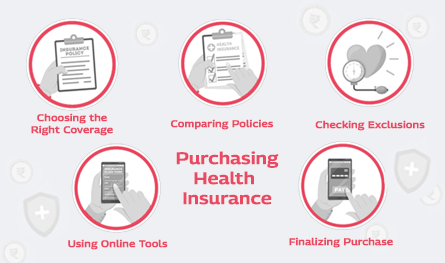

Considering the steep inflation in the medical and healthcare sector, having health insurance has become a must-have for every household. The absence of a reliable health plan will not only deplete your hard-earned savings but will add to your stress, too. The pandemic outbreak has revealed the importance of health plans the hard way.

Nobody can surely predict the future, but reliable health insurance can protect it well for sure. Uncertainty is the very essence of life; the 2020 pandemic outbreak has taught it the hard way. Securing your and your family’s health is a matter of responsibility and concern rather than that of luxury.

Health insurance acts as a protective shield for you and your family members, offering financial protection against medical emergencies. Considering the steep inflation rate in the healthcare sector, a few days of hospitalisation is enough to deplete a significant portion of your savings, especially if it involves a surgical procedure of any sort.

In today’s time, when medical inflation is at an all-time high, it has become a necessity to purchase a robust health insurance plan. Whether it is an emergency hospitalisation or treatment for a critical illness, health insurance plans are there to help.

When it comes to choosing a health insurance plan, there are typically two options: indemnity health insurance and fixed benefit health insurance. The indemnity health insurance plan is a more popular option; let’s understand why.

Taking control of your health means more than just reacting to illness; it means proactively safeguarding your well-being. With the escalating costs of medical care, a comprehensive health insurance policy is no longer optional—it's vital.

.png)

Everyone looks at getting knowledge about different kinds of insurance plans. However, people hardly consider seeking awareness about the rights of insurance policyholders. Let us discuss them in this post.

Car Insurance

Car Insurance