Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

.png)

.png)

There are no doubts about the need to take care of your health, particularly at a moment when people around the world are still recovering from the effects of a devastating pandemic. In India, the awareness surrounding health insurance plans has increased in the recent years. However, there is a common perception among the population on the difference between mediclaim and health insurance since they sound alike. In reality, both are distinct products that are used in different situations. Let’s us try to throw some light on the mediclaim vs. health insurance debate that has been going on for a long time.

What are differences between Medi-claim and health insurance plan

Mediclaim meaning Mediclaim insurance, is a kind of health insurance policy that helps reduce your costs by offering coverage to cover hospitalization costs for general ailments. In addition, it typically covers diagnostics reports, consultations of doctors with discharge certificates and treatment costs, medical bills, etc. It is also possible to get an exclusive Mediclaim policy for all members in your family, such as the spouse and children and parents as well as other members, for a specified amount, as it protects your whole family. In addition, it also provides tax benefits by Section 80D under the Income Tax Act, similar to the deductions that are available for premiums paid for insurance.

Health Insurance from PayBima

A health insurance policy is a kind of medical insurance that may be accessed either by a group or an individual to safeguard against growing medical costs. In this case, the insured gets reimbursed for hospitalization costs or receives cashless services when admitted to one of the hospitals within the network of the insurer. You can also choose the family floater health insurance that provides all-inclusive health insurance for all members of the family at a low cost. Because there is more coverage in the health insurance policy than a mediclaim insurance policy, it is more comprehensive.

To get a better understanding of what a Mediclaim as well as a health insurance plan is, we can discuss the difference between health insurance and medical insurance, which will assist you in deciding which one is the best to purchase.

We have tried to look into the difference between health insurance vs medical insurance to help you choose between mediclaim or health insurance and which one can be more beneficial. While both serve its purpose, it is the responsibility of the buyer to evaluate their requirements and select the one that is best suited for their needs. As the amount of lifestyle diseases is growing each day, we have a responsibility to safeguard ourselves and our family members in case of a medical crisis. If it is necessary to go to the hospital and avail treatment, it is imperative to possess a solid insurance plan in hand so that you don’t burn your pocket. And yes, the experts at PayBima can help you decide what mediclaim policy would best suit your needs.

The differences between mediclaim & Health Insurance on the face of it are not major, but when it comes to getting claims reimbursed, an insurance policy covers more and allows greater protection. However, a mediclaim is also very affordable, making it an option that many people opt for.

Health insurance provides extensive coverage for various health conditions. Medical insurance provides limited coverage for specific health emergencies.

A Mediclaim policy is a sort of health insurance policy in which the insurer reimburses the policyholder for medical expenses incurred in treating their medical condition. If you have a medical insurance policy, you can submit your bills to the insurance company for payment.

Young and healthy? Find out which of these plans rewards you with lower premiums. Click here to check now!

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 21 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

.jpg)

Having a bike is not just about convenience, it’s a huge responsibility. Financial protection of your two-wheeler is important and the best way to ensure that is to have a bike insurance policy that will protect you in case of an accident, theft or a natural calamity. There are so many options when it comes to policies, making it difficult to know what’s best. This guide makes it easier to choose the best bike insurance policy that is suitable for you.

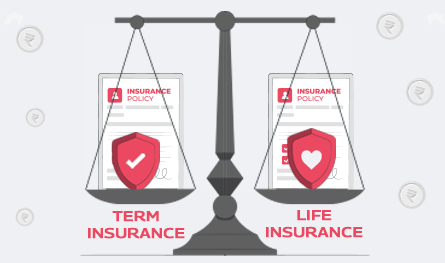

Insurance decisions can be confusing. Especially, when you're staring at two plans that sound almost identical but do very different things. Term insurance promises high coverage at a low price, but no money back if you survive. Life insurance, on the other hand, may come with savings, returns, and bonuses, but it often comes at a higher cost.

.jpg)

Sometimes, we do not pay as much time and heed to car insurance policies as we do for life insurance plans. While this is quite natural, you must know that such a mistake can lead to heavy financial losses.

Even though people are now changing and more and more individuals have begun opting for car insurance, most people from the upper and lower-middle-class sections in India are not aware of why their insurance premiums vary so much.

Knowing about such variations and the factors that cause such variations won’t just educate you about premiums. It will also help you address higher premiums and tackle them effectively.

Fixed Deposits (FDs) are one of the safest ways to grow your savings. HDFC Bank offers attractive FD interest rates, allowing you to earn guaranteed returns on your investment. But before you invest, it's important to know how much interest you will earn and what your final maturity amount will be.