Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

.png)

A health insurance plan has become a common necessity in today’s inflationary age when medical expenses have become unaffordable. That is why many of you buy a health plan to secure your finances against any medical contingency which you might face. Many often than not, you buy health insurance without much consideration. Later you realise that there are other better plans out there in the market. If, however, you have been careful when selecting a plan, there might be other reasons which might make you think of switching to a new health insurance plan. But what about the renewal benefits which your current health plan gives? Can you retain them when you switch to another plan?

.png)

Yes, you can through the feature called porting of health insurance. Do you know what portability means?

Health insurance plans are flexible in nature. They allow you to opt for additional coverage features, the policy tenure, and also allow portability. Portability means changing your health plan with another plan from the same insurance company or from another insurance company. When you port, you get the renewal benefits of your existing health plan.

You can port your health insurance plan only at the time of renewing your health insurance policy. Only when the chosen term of the plan comes to an end is porting allowed. So, if you buy an annual plan, you can port when the plan completes one year. In case you have chosen a term of two or three years, porting is allowed only after the completion of the chosen term.

You have to make a request to your existing insurance company about your intention to port. Porting doesn’t happen automatically. This request should be made at least 45 days prior to your policy renewal date. In case the request is not submitted 45 days in advance, there might be problems with your porting request. Even the new insurer should be notified of your interest in porting your existing health insurance to their plan.

The pre-existing waiting period which has already elapsed in your existing health insurance policy would be given credit for in the new policy. So, if the waiting period in the existing plan is 4 years and you have continued the policy for 2 years before porting, the waiting period in the new policy would be reduced by 2 years. So, if the new policy’s waiting period is 3 years, the applicable period would be 1 year only.

Many health plans increase the sum insured if you don’t make a claim in a policy year. This increase is cumulative in nature and increases for every claim-free year and increases the sum insured. In case of health insurance portability, you might or might not get credit for the accumulated no claim bonus. Some companies allow you to retain your accumulated increase in sum insured while some don’t. So, check for this credit when porting.

So, keep these things in mind when you opt for health insurance portability.

Here’s how health insurance portability works in India:

Young and healthy? Find out which of these plans rewards you with lower premiums. Click here to check now!

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 21 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

.jpg)

Having a bike is not just about convenience, it’s a huge responsibility. Financial protection of your two-wheeler is important and the best way to ensure that is to have a bike insurance policy that will protect you in case of an accident, theft or a natural calamity. There are so many options when it comes to policies, making it difficult to know what’s best. This guide makes it easier to choose the best bike insurance policy that is suitable for you.

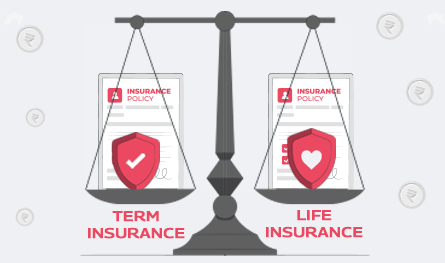

Insurance decisions can be confusing. Especially, when you're staring at two plans that sound almost identical but do very different things. Term insurance promises high coverage at a low price, but no money back if you survive. Life insurance, on the other hand, may come with savings, returns, and bonuses, but it often comes at a higher cost.

.jpg)

Sometimes, we do not pay as much time and heed to car insurance policies as we do for life insurance plans. While this is quite natural, you must know that such a mistake can lead to heavy financial losses.

Even though people are now changing and more and more individuals have begun opting for car insurance, most people from the upper and lower-middle-class sections in India are not aware of why their insurance premiums vary so much.

Knowing about such variations and the factors that cause such variations won’t just educate you about premiums. It will also help you address higher premiums and tackle them effectively.

Fixed Deposits (FDs) are one of the safest ways to grow your savings. HDFC Bank offers attractive FD interest rates, allowing you to earn guaranteed returns on your investment. But before you invest, it's important to know how much interest you will earn and what your final maturity amount will be.