Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

.png)

Are you looking at getting LASIK Eye Surgery for your troubled vision and want to know if LASIK Eye Surgery is Covered under Health Insurance Policy? Read on to know more about what is LASIK, is lasik covered by insurance, and companies that cover LASIK eye surgery in India.

.png)

Troubling vision is something that the majority of the Indian population suffers from. And most people turn to LASIK eye surgery as a cure. But when it comes to availing your health insurance policy for getting a LASIK Eye surgery, the most common question that insurance policyholders ask is, Is LASIK covered by insurance? Since these surgeries have become quite common, a query about whether LASIK eye surgery is covered under mediclaim policies or not should be addressed.

In this blog, we are discussing if LASIK surgery is covered by insurance or if it is covered under basic health insurance plans. Also, we are giving you some details about the eligibility criteria of the plan among other things.

LASIK or Laser-Assisted in Situ Keratomileusis is a surgery related to the eyes to rectify any vision related issues. This surgery can be used to cure conditions like hyperopia or farsightedness, myopia, astigmatism etc. This surgery is known to be a complicated one as it involves a complex procedure.

To determine this eye problem, the doctor first does some kind of testing on the patient after analyzing his/her medical history. After that, the doctor decides whether the patient is eligible for LASIK Surgery. Only after the eligibility is confirmed, the expenses are considered.

Also, the insured in such case consider if their medical insurance policy covers LASIK Eye Surgery. Though there are many insurers who offer coverage for LASIK eye surgery but still there are many who do not cover this treatment under their health insurance plans. To answer your query why is LASIK not covered by insurance? It is because some insurance companies consider LASIK a part of cosmetic surgery and hence not necessary medically. But of course things are changing and there are quite a few insurance providers who cover it.

Below are 6 best insurance companies that cover LASIK eye surgery in India –

Network Hospitals – 5700+

Covers Lasik Eye Surgery under all their Health Plans

Network Hospitals – 6500+

Covers Lasik Eye Surgery under all their Health Plans

Network Hospitals – 6000+

Covers Lasik Eye Surgery under all their Health Plans

Network Hospitals – 6500+

Covers Lasik Eye Surgery under all their Health Plans

Network Hospitals – 4700+

Covers Lasik Eye Surgery under all their Health Plans

LASIK Eye Surgery helps people within the age group of 18-40 years. In fact, this age group is considered apt for LASIK treatment. However, people above 40 years can also undergo the surgery depending on health conditions. As soon as you complete one year of wearing glasses, you can undergo eye laser surgery insurance coverage. Further, changes in technology have also led to changes in the criteria for eligibility for surgery.

Does mediclaim cover LASIK surgery? You might be asking this question before planning for a LASIK eye surgery. Yes, many Indian health insurance companies consider LASIK eye surgery as an optional treatment and thus may not cover it under their policies. However, there are some insurers who offer LASIK Eye Surgery as part of their health insurance policies with certain conditions, such as;

Young and healthy? Find out which of these plans rewards you with lower premiums. Click here to check now!

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 21 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

.jpg)

Having a bike is not just about convenience, it’s a huge responsibility. Financial protection of your two-wheeler is important and the best way to ensure that is to have a bike insurance policy that will protect you in case of an accident, theft or a natural calamity. There are so many options when it comes to policies, making it difficult to know what’s best. This guide makes it easier to choose the best bike insurance policy that is suitable for you.

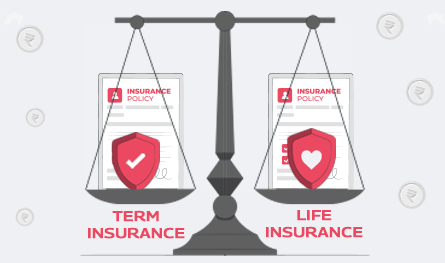

Insurance decisions can be confusing. Especially, when you're staring at two plans that sound almost identical but do very different things. Term insurance promises high coverage at a low price, but no money back if you survive. Life insurance, on the other hand, may come with savings, returns, and bonuses, but it often comes at a higher cost.

.jpg)

Sometimes, we do not pay as much time and heed to car insurance policies as we do for life insurance plans. While this is quite natural, you must know that such a mistake can lead to heavy financial losses.

Even though people are now changing and more and more individuals have begun opting for car insurance, most people from the upper and lower-middle-class sections in India are not aware of why their insurance premiums vary so much.

Knowing about such variations and the factors that cause such variations won’t just educate you about premiums. It will also help you address higher premiums and tackle them effectively.

Fixed Deposits (FDs) are one of the safest ways to grow your savings. HDFC Bank offers attractive FD interest rates, allowing you to earn guaranteed returns on your investment. But before you invest, it's important to know how much interest you will earn and what your final maturity amount will be.