Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

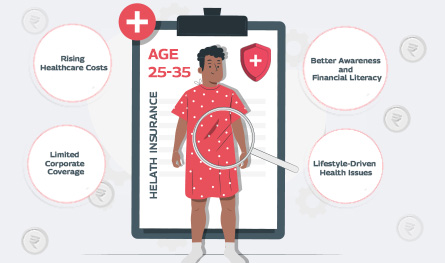

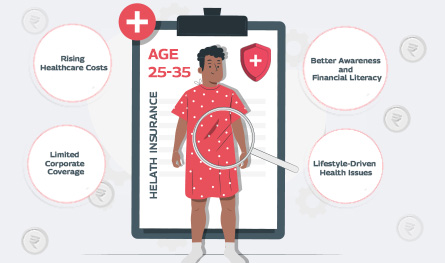

In what’s being called a quiet healthcare revolution, India’s young working professionals are reportedly making the most health insurance claims – outpacing even senior citizens. Surprised? So are the insurance providers. Young adults ranging between 25 and 35 years, who are often assumed to be in peak health, are now dominating the charts in health insurance claims by age.

As the costs of medical attention continue to rise, this generation is turning to health insurance plans not just as a fallback option but as a smart financial tool – reshaping how we view health insurance plans.

Long work hours, grab-and-go meals, endless screen time, and lack of exercise are common among young adults, contributing to health issues like hypertension, anxiety disorders, and diabetes. These problems are not just minor inconveniences to the regular lifestyle; in some cases, they lead to medical treatments or even hospitalisations that result in health insurance claims. As a result, more young adults are making health insurance a priority - often right after landing their first job - because paying a premium is much easier than footing an unexpected hospital bill.

This new working generation is more financially informed than ever. With access to finance influences, digital content, and insurance comparison tools, young adults understand the importance of getting a comprehensive health insurance plan early. They are no longer waiting for a medical emergency – they are planning ahead. Expert platforms like Paybima help them find their ideal coverage, ensuring they are covered in case of minor as well as major healthcare needs. As a result, young adults are making smart decisions, contributing to the shift in health insurance claims by age.

The cost of quality medical attention in India is skyrocketing. A simple outpatient procedure or a diagnostic test can cause a financial issue if not planned properly. The 25 – 35 age group, with its preference for reliable and quick care, tends to rely on private healthcare facilities. Since these facilities readily accept health insurance for non-critical treatments, this has led to a spike in health insurance claims for such treatments.

Most corporate employee benefit plans include an employer-provided health insurance plan that covers the employee up to a certain limit. The premiums for this coverage are covered by the employer. Therefore, the insured does not have to think twice before asking for insurance claims for routine treatments. However, these plans also come with limited benefits. So, with the help of online platforms like Paybima, young professionals can review and supplement their corporate insurance plan with another robust plan to cover all bases. This allows them a base to fall back if their corporate coverage does not cover any specific treatment or procedure.

The COVID-19 pandemic has surely changed how young Indians view healthcare. This generation has witnessed their parents and other senior family members get seriously ill – in fact, many in this age group experienced this themselves, mixed with post-viral complications and anxiety-related concerns. This has caused a spike in doctor consultations, leading to diagnostics and even hospital stays – many of which are covered by health insurance claims. As a result, more young adults use their health insurance to get the maximum benefit.

Most individuals living in the 25 – 35 age range are starting families, leading to a rise in maternity and parenthood-related health insurance claims. From prenatal check-ups to newborn care, the medical expenses can add up – especially if you are looking for reliable care in private hospitals. This results in more and more maternity-related health insurance claims coming from young adults in this age range, thus contributing to the trend of shifting the volume of health insurance claims by age.

Young and healthy? Find out which of these plans rewards you with lower premiums. Click here to check now!

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 21 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

.jpg)

Having a bike is not just about convenience, it’s a huge responsibility. Financial protection of your two-wheeler is important and the best way to ensure that is to have a bike insurance policy that will protect you in case of an accident, theft or a natural calamity. There are so many options when it comes to policies, making it difficult to know what’s best. This guide makes it easier to choose the best bike insurance policy that is suitable for you.

Non-linked, non-participating term plans are the ones that do not participate in the business and profit of the insurance company. These are fixed premium plans where the policyholder pays a fixed amount to ascertain a guaranteed sum as a return to be paid to the nominee in case of his/ her demise. Let’s learn more in this post.

Car depreciation implies the difference between the cost of a car at the time of buying the car and when you sell it. A car insurance claim amount is determined by the car depreciation rate. The car depreciation rate is the reduction in the value of your car over its lifespan caused by wear and tear.

Have you ever caught yourself lost in illusions about your daughter's future events, such as her university convocation and first day at work? Her university convocation. When she embarks upon her initial job after graduation will be the day.

.png)

Accidents can happen anywhere, anytime, by your own fault or another person. What’s important is to be prepared for such mishaps. This is where Own Damage Car Insurance comes in handy.