The latest circular issued by the regulator notes the rising risk of equities and volatility that insurance firms are exposed to. “Taking into account the demands of insurers and the tendency towards equity investments, there was a need to allow hedging through equity derivatives as a counteraction,” IRDAI explained. Therefore, insurers can now employ stock and index futures and options to manage their existing equity risks in accordance with the set rules.

Impact on Insurance Companies

The new regulation is especially important for life insurers who are engaged in managing Unit Linked Insurance Plans (ULIPs) because these products have a high level of exposure to equities. The use of derivatives will help insurers manage their risks and maintain a stable return on investments while safeguarding the policyholders’ interests.

This has been applauded by various stakeholders in the industry. Speaking to media, Aneesh Srivastava, Chief Investment Officer at Star Health Insurance said that the regulation will provide insurers with more freedom to manage their investment portfolio. “Derivatives as a hedging tool will be most useful to life insurers who deal with ULIP portfolios. Still, it may take a few months to implement it since it requires system preparedness, board approval, and process changes, he added.

Regulatory Framework and Governance Requirements

To avoid any loophole in the implementation of the regulation, IRDAI has put in place a detailed regulatory framework that regulates insurers’ operations in the derivatives market:

- Permitted Instruments – Insurers are allowed to engage in the use of equity derivatives for hedging only and are restricted from having OTC derivative exposure.

- Position Limits –Exposure and position limits must comply with regulatory requirements to prevent the excessive use of derivatives.

- Board-Approved Hedging Policy – Every insurer is required to have a hedging policy that has to be approved by the board of directors, and the hedging policy has to be supported by the internal risk management frameworks and periodic audits.

- IT and Operational Readiness – Companies must establish the appropriate IT systems to track and control the derivative positions.

- Derivative Contracts – The board and senior management have the responsibility of ensuring that derivative contracts are not prejudicial to policyholders. Also, the insurers are required to provide information on derivative transactions in the sales brochures of ULIPs to ensure that the customers are informed.

- Regulatory Reporting – Insurers are obliged to file reports for turnover, position closure and profit or loss from equity derivative contracts every quarter.

Current Derivatives Framework for Insurers

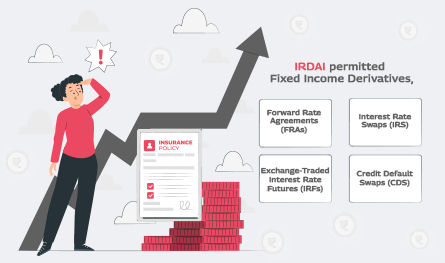

The IRDAI had permitted insurers to invest in Fixed Income Derivatives, like:

- Forward Rate Agreements (FRAs)

- Interest Rate Swaps (IRS)

- Exchange-Traded Interest Rate Futures (IRFs)

- Credit Default Swaps (CDS) from the Protection Buyers Perspective

Equity derivatives have become another tool in the hands of insurers to manage their investment risks and thus enhancing their portfolio.

.jpg)

.png)