BMI Calculator for Men: Track Your Fitness & Health Goals

Ever found yourself second-guessing those extra helpings of dessert or the gym sessions you promised you’d start on Monday? We’ve all been there. In a world where fitness advice comes from every direction — from your smartwatch to that one friend obsessed with green smoothies — it is easy to feel a little lost about where you stand health-wise. This is exactly where a simple online tool like a BMI calculator for men can help your cat through the noise.

An online BMI calculator is a quick and effective way to get an idea of your health by comparing your height and weight. Think of it as a health status check – without awkward doctor visits or complicated health jargon.

This article will be your guide to breaking down what a BMI calculator is, how to use a BMI calculator for men, and why it is important.

What is a BMI Calculator?

BMI stands for Body Mass Index – a quick formula that requires you to input your current height and weight to estimate whether you fall within a healthy weight range for your build. An online BMI calculator for men can do that for you in seconds. It does not require any fancy spreadsheets or any complicated jargon – just your basic measurement and a minute of your time.

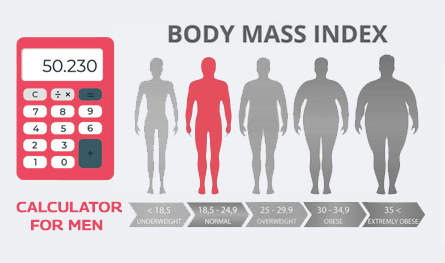

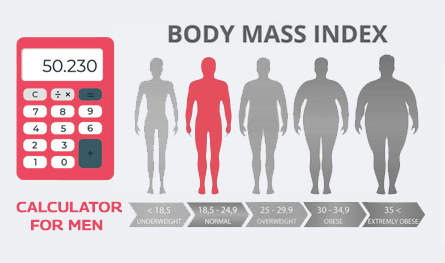

The general BMI categories for men are:

- Underweight – Below 18.5

- Normal weight – Between 18.5 and 24.9

- Overweight – Between 25 and 29.9

- Obese – 30 and above

Now, it is important to understand that while this score can give you a starting point, this is by no means the final verdict on your current health condition.

How to Use A BMI Calculator for Men?

Here is a step-by-step breakdown of how to use a BMI calculator online:

- Search for “BMI calculator for men”. There will be a list of free tools for you to choose from.

- Enter your age. Do not shave off some years here – accuracy matters in this case.

- Add in your current weight. Most calculators will let you choose between pounds or kilograms.

- Pop in your current height. Whether you use feet, inches, or centimetres, most calculators have all these options.

- Click on “Calculate”.

In a few seconds, you will be provided with your current BMI score. You will compare the score with the above-mentioned list of categories to get an idea of where you currently stand health-wise.

Why is tracking BMI important?

Now, you might be thinking BMI is just a number, surely, but it can offer some valuable insights. Tracking BMI can help you:

- Get an estimate on your current health status.

- Set realistic fitness goals.

- Monitor your progress over time.

- Identify potential medical risks early.

With all these in mind, you need to understand the limitations of this BMI calculator. The body mass index score does not distinguish between fat and muscle. It doesn’t care if those extra kilos come from late-night pizza runs or your hard-earned biceps. So, if you’ve been hitting the gym and building muscle, don’t be surprised if it labels you as overweight. The calculator judges people based only on the two variables provided – height and weight. Therefore, it is advisable to use this as a general guide rather than a strict health scorecard.

In short, treat it like a helpful indicator, not a final scorecard. A smart move? Check your BMI every couple of months — especially if you’ve been tweaking your diet, workout routine, or lifestyle. It’s a fuss-free way to track your progress without getting too caught up in the numbers game.

Other Factors You Should Consider

While your BMI score can be a good point to start, it is also wise to keep an eye on other health indicators, including:

- Body fat percentage

- Blood pressure

- Physical activity levels

- Cholesterol levels, etc.

Together, when paired with the results from the BMI calculator for men, these can provide you with a complete picture of your health and fitness levels.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 21 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Latest Post

.jpg)

Having a bike is not just about convenience, it’s a huge responsibility. Financial protection of your two-wheeler is important and the best way to ensure that is to have a bike insurance policy that will protect you in case of an accident, theft or a natural calamity. There are so many options when it comes to policies, making it difficult to know what’s best. This guide makes it easier to choose the best bike insurance policy that is suitable for you.

Non-linked, non-participating term plans are the ones that do not participate in the business and profit of the insurance company. These are fixed premium plans where the policyholder pays a fixed amount to ascertain a guaranteed sum as a return to be paid to the nominee in case of his/ her demise. Let’s learn more in this post.

Car depreciation implies the difference between the cost of a car at the time of buying the car and when you sell it. A car insurance claim amount is determined by the car depreciation rate. The car depreciation rate is the reduction in the value of your car over its lifespan caused by wear and tear.

Have you ever caught yourself lost in illusions about your daughter's future events, such as her university convocation and first day at work? Her university convocation. When she embarks upon her initial job after graduation will be the day.

.png)

Accidents can happen anywhere, anytime, by your own fault or another person. What’s important is to be prepared for such mishaps. This is where Own Damage Car Insurance comes in handy.