BMI Calculator for Women: Stay Fit & Healthy with the Right Weight

Have you ever caught yourself thinking whether your weight is right where it should be, or if those midnight snack cravings are quietly making their mark? Trust me, you’re not alone. With endless advice from fitness influencers, trendy diet fads, and that one friend who insists everything can be fixed with green tea, it’s no wonder it gets confusing. What does “healthy” even mean for you?

That’s exactly where a hassle-free online BMI calculator for women steps in. In this guide, we’ll break down what BMI is and how you can use one of these simple tools to get a quick, honest check-in on your health.

What Does BMI Mean?

BMI, or Body Mass Index, might sound like something you’d only hear in a doctor’s office, but it’s one of the easiest ways to get a rough idea of where you stand health-wise. It does not include any complicated medical tests or any medical jargon — just your height, your weight, and a number that helps you understand if you’re within a healthy weight range.

Think of it as a health reality check. The calculator won’t reveal your cardio stamina or how much you stay at the gym, but it will give you a starting point to work from. So, whether you are hoping to lose a few kilos, maintain where you are, or simply track your health, knowing your BMI helps you set goals you can stick to.

How to Use the BMI Calculator for Women?

The following is a step-by-step explanation of how a woman should utilise the BMI tool:

- Begin by looking up “BMI calculator for women” on the internet, and you’ll find loads of free and accessible tools. Choose one that you find appealing.

- Then enter your age. Don't guess — honesty is the best policy in this case.

- Then enter your current weight. Most calculators have the option for both kilograms and pounds, so enter whichever is easiest.

- Then enter your height. Enter it however you prefer - in centimetres, feet and inches, or as you like.

- Then press the ‘Calculate’ button and witness the tool perform its magic.

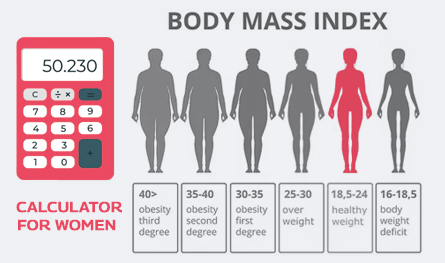

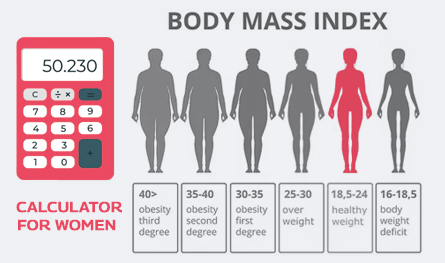

Now you will receive a BMI number. Based on that number, you simply have to determine in which of the following categories you fall.

- Below 18.5 – Underweight

- 18.5 - 24.9: Healthy weight

- 25 to 29.9 – Overweight

- 30 and over – Obese

These categories provide a general idea of where you are, but it should be kept in mind that the calculator does not consider factors such as muscle mass and body composition.

How to Maintain a Healthy BMI Number?

Now, if your BMI number is not where you expected it to be, here are some tips on how to improve and maintain a healthy score:

- You need to focus on having healthy and balanced meals. You don’t have to give up on dessert forever, you just need to have fewer ice-creams. Make healthier food swaps.

- You need to be physically active. Be it running, swimming, yoga, or just walking – all of these work.

- You need to have enough sleep. Maybe it is time to work on your sleep schedule.

- You need to manage your stress levels. Find whatever calms you down, whether it is memes or meditation.

- You need to stay hydrated. Sometimes, thirst disguises itself as hunger, causing overeating problems.

What Your BMI Can Tell You and What It Can’t?

While the BMI calculator for women can give you a helpful snapshot of your ideal weight-to-height ratio, it is not the ultimate authority on your health. Here is what the tool can tell you:

- If you are within a general healthy weight range.

- If you need to tweak your lifestyle habits.

But here is what the tool won’t tell you:

- How fit are you

- If you have a good balance of muscle and fat

For example, someone who hits the gym a lot and has a higher muscle mass might have a higher BMI number but still be very healthy.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 21 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Latest Post

.jpg)

Having a bike is not just about convenience, it’s a huge responsibility. Financial protection of your two-wheeler is important and the best way to ensure that is to have a bike insurance policy that will protect you in case of an accident, theft or a natural calamity. There are so many options when it comes to policies, making it difficult to know what’s best. This guide makes it easier to choose the best bike insurance policy that is suitable for you.

Non-linked, non-participating term plans are the ones that do not participate in the business and profit of the insurance company. These are fixed premium plans where the policyholder pays a fixed amount to ascertain a guaranteed sum as a return to be paid to the nominee in case of his/ her demise. Let’s learn more in this post.

Car depreciation implies the difference between the cost of a car at the time of buying the car and when you sell it. A car insurance claim amount is determined by the car depreciation rate. The car depreciation rate is the reduction in the value of your car over its lifespan caused by wear and tear.

Have you ever caught yourself lost in illusions about your daughter's future events, such as her university convocation and first day at work? Her university convocation. When she embarks upon her initial job after graduation will be the day.

.png)

Accidents can happen anywhere, anytime, by your own fault or another person. What’s important is to be prepared for such mishaps. This is where Own Damage Car Insurance comes in handy.