Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

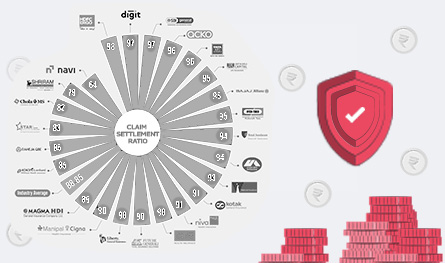

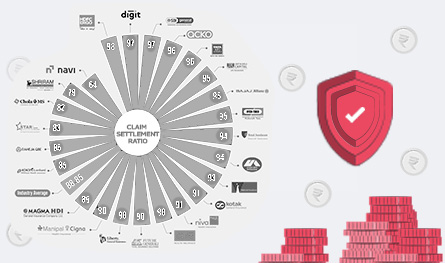

Different insurance companies operate under distinct practices in the industry. The claim settlement ratio (CSR) represents an essential criterion that policyholders need to evaluate before making a decision. The straightforward measure provides substantial information about the insurer. The percentage of paid claims represents the relationship between paid claims versus total received claims for an insurance company. The CSR represents a critical parameter for insurance customers to assess. This ratio provides an indicator that helps policyholders evaluate insurer trustworthiness.

The claim settlement ratio computation requires a straightforward mathematical formula. To determine the CSR, you would use the settled claims number as the numerator, divide by total received claims and then multiply the value by 100. Suppose an insurance company receives a total of 100 claims throughout a year and pays out 95 of these claims. Its CSR is 95%. Simple, right? The payout rate of an insurer is revealed through this percentage figure. A company that demonstrates a high claim settlement ratio suggests quick payments and reliability in terms of claim processing.

The public claim settlement ratios displayed by many insurance companies in India have become a common practice. According to recent statistics, major insurance providers demonstrate average CSR performance exceeding 90%.

The settlement rate for life insurance is published in the IRDAI Annual Report. However, the claim settlement ratio for general insurance policies is data that the IRDAI does not publish; instead, it is published by individual insurers. The IRDAI publishes the ICR (Incurred Claim ratio) data. This data shows how much the insurer pays out in claims compared to the total premium it collects. Sometimes, it can be more than 100%, but in that case, the insurer is making a loss.

Before purchasing an insurance policy, understanding the CSR becomes necessary. Your chance of receiving a claim settlement promptly improves when the insurance provider has a good CSR. The insurance process requires more than just premium payment. The belief that one needs one's insurance provider stands as a fundamental element in times of crisis. Your expectation is a quick resolution after filing a claim with your insurance provider.

Customers must consider a low claim settlement ratio to be problematic. The operation might create additional delays, together with administrative obstacles. The insurer demonstrates limited ability to handle claims when its settlement ratio is low. Every customer has the right to receive help during their interactions with the insurance provider. Check the insurer’s CSR before making any final commitments through the signature.

The Insurance Regulatory and Development Authority of India (IRDAI) actively monitors these ratios as part of its oversight role. Modern customers feel more in control of their insurance choices when they see a high number of settled claims.

Everyone likes to see numbers. The claim settlement ratio stands as the most basic yet reliable indicator for evaluation purposes. The numerical value of percentages is simple to understand by most people.

However, what needs to be kept in mind is that the Claim Settlement Ratio is not the ONLY aspect that needs to be considered while opting for a health insurance plan for your family. There are other crucial aspects to consider, such as the claims process and customer service. Ensure you fill out the form accurately so that there are no concerns at the time of claim payout.

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Let’s be honest – life insurance planning isn’t exactly someone’s weekend hobby. It is the financial equivalent of flossing: we understand its importance, but we tend to put it off. But somewhere between balancing work and life, you might realise you need to have a solid plan in place – just in case.

Getting older is a mixed bag. On one hand, you have experience, wisdom, and the ability to spot and avoid a telemarketing scam from a mile away. On the other hand, your back makes creaking noises when you get out of bed.

As any parent will tell you, kids come with two things: endless energy and absolutely no sense of self-preservation. From scaling chairs and tables like mountaineers to catching germs within a five-mile radius, kids really know how to keep everyone on their toes. Now, it is understandable you are worried. As much as we would love to wrap our small ones in cotton wool and keep them safe forever, real life has other plans.

When was the last time you thought about getting a life insurance policy? If your answer is “I will get to it someday”, you are not alone. Despite India growing as one of the fastest expanding economies, life insurance penetration across the nation has remained surprisingly low. Life insurance penetration fell slightly to 2.8% in FY24, down from 3% in the previous year.

Let’s be honest, your health does not come with a warning sign. One moment you are enjoying your breakfast, and maybe in the next, you're staring at a hospital bill that looks like a phone number. This is why having solid medical insurance is not a luxury anymore. It is your financial shield, your plan B, and your peace of mind, all rolled into one.