Reasons to Get Term Insurance in 2025 Even if You are Single – A Detailed Guide

.png)

Life insurance is generally associated with individuals who are married with kids. But that doesn’t imply that singles can’t purchase term insurance. Let’s take a look at the reasons for singles to buy term plans.

.png)

There is no right age or right time to buy a term insurance plan. People can start their insurance journey anytime in life. Generally married men/women are more inclined towards purchasing term insurance policies, but singles can also buy term plans early on in life to benefit from it in the later stages.

In fact, there is no reason for singles to not buy term insurance to gain benefit from it. Further, there are many people who are unmarried but who have several liabilities. For example, if you are an earning member of your family living with your old parents and young siblings, it becomes your responsibility to buy a term plan to financially secure the younger ones in the family.

Let’s take a look at the reasons or benefits of buying a term insurance plan by single individuals in this post.

What Is Term Insurance and Why Do You Need It?

In simple words, term insurance is a plain form of life insurance that allows financial security to the family of the person buying a term policy in the event of sudden death of the individual during the policy term. The policy term is a particular time period during which the policy stays active and covers the insured. Hence, it is named a Term Insurance plan. The policyholder in return has to pay a certain amount known as premium. Term plans are comparatively less costly than most other insurance products.

Let us discuss the reasons why term insurance is a must for everyone including those who are single

Top 3 Reasons Why Should Single Individuals Buy Term Insurance ?

Here are some reasons why even the singles should consider buying term insurance:

1. Why Should Single Individuals Buy Term Insurance?

Often, young single individuals who are earning have dependents like siblings or aged parents who rely on their income totally or partially to run their household comfortably. In such a situation, if something happens to that person, the family’s financial equilibrium gets affected. Hence, to support your dependents and aged parents, you must get the benefit of term plans. Moreover, if you buy a term plan at a young age, you also get the benefit of getting it at a very low premium rate. This might also serve your purpose when you settle down in life later and start a family.

Further, if you have an educational loan going on in your name, the term plan can help your ageing parents to clear the loan if anything untoward happens to you. So, this way you can help them clear debts rather than burdening them with the added liability.

2. For single parent

Every parent wants to secure their child’s future and watch them prosper in their career. Of course, it involves a certain amount of expenditure. And if you are a single parent taking care of your child on your own, it becomes all the more important to secure your child’s future financially. Hence, you must opt for a term plan. This is because if any unforeseen situation comes in your life, your child may not fulfil his/her dreams of higher studies. In that case, the financial security of term plan can support your child through any such unfortunate events

3. Better coverage at reasonable premium rates

18 years is the minimum age of eligibility that is required to buy a term plan. So, anyone can avail a term policy early on in life when they are single and have just started their career. Buying a term plan early on allows the singles to avail the policy at better and very economical premium rates. Besides, you also get greater coverage. So, buying term plan earlier is better for single individuals.

Reasons to Get Term Insurance Even if You are Single

Yes, the premium of a term insurance plan generally varies depending on whether the insured is a smoker or a non-smoker. For smokers, the premium amount is generally higher as compared to non-smoker.

A policy of life insurance allows the policyholder to enjoy maturity benefits. On the other hand, a term insurance plan does not have the facility of maturity benefits. It simply allows the nominee(s) to receive the sum assured as death benefit in case of policyholder's demise.

Yes, NRI's with dual citizenship who qualify as citizens of India are eligible to buy term insurance in India.

For people who do not have anyone to call as dependents and who don't plan to have a family may skip buying a term insurance. However, if you have parents or anyone who depends on your income, you may buy an economical term plan. This will also help you in saving tax.

Yes, a single person can buy term insurance because it will support him/her later on in life when they start a family. Also, these plans can secure the aged parents of an individual. Further, tax exemption is another aspect because of which people buy term insurance plans.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 21 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Other Life Insurance Products

Latest Post

.jpg)

Having a bike is not just about convenience, it’s a huge responsibility. Financial protection of your two-wheeler is important and the best way to ensure that is to have a bike insurance policy that will protect you in case of an accident, theft or a natural calamity. There are so many options when it comes to policies, making it difficult to know what’s best. This guide makes it easier to choose the best bike insurance policy that is suitable for you.

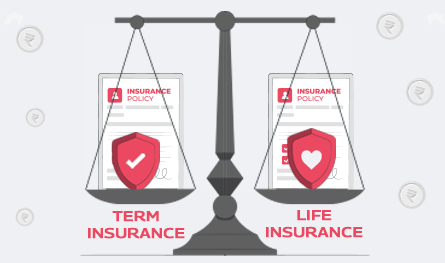

Insurance decisions can be confusing. Especially, when you're staring at two plans that sound almost identical but do very different things. Term insurance promises high coverage at a low price, but no money back if you survive. Life insurance, on the other hand, may come with savings, returns, and bonuses, but it often comes at a higher cost.

.jpg)

Sometimes, we do not pay as much time and heed to car insurance policies as we do for life insurance plans. While this is quite natural, you must know that such a mistake can lead to heavy financial losses.

Even though people are now changing and more and more individuals have begun opting for car insurance, most people from the upper and lower-middle-class sections in India are not aware of why their insurance premiums vary so much.

Knowing about such variations and the factors that cause such variations won’t just educate you about premiums. It will also help you address higher premiums and tackle them effectively.

Fixed Deposits (FDs) are one of the safest ways to grow your savings. HDFC Bank offers attractive FD interest rates, allowing you to earn guaranteed returns on your investment. But before you invest, it's important to know how much interest you will earn and what your final maturity amount will be.