Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

There are many issues that the health insurance sector has often struggled with. This includes problems like delayed claim processing, complex paperwork, and fraud detection. However, with AI in the picture, things are changing fast and for the better. With many insurers using AI for health insurance today, they are better able to handle repetitive tasks, streamline claims, and improve customer satisfaction.

There are several key areas in health insurance where AI is being used effectively. This includes:

Automation of Claim Processing, as AI tools can read, interpret, and verify documents faster than humans.

Using Chatbots for Customer Support, which lets insurers deploy AI-driven bots to handle simple queries instantly.

Easy Fraud Detection with the help of predictive analytics, which spots suspicious claims through patterns based on previous fraud cases.

The best thing about these changes is that they not only help insurers but also empower customers by providing them with faster responses and better service.

You have to agree that one of the most complicated parts of insurance is filing a claim. The usual methods mostly involve filling up forms, follow-ups, and long wait times. This is what AI has changed to a great extent.

AI, with the help of natural language processing or NLP, software are better able to understand a doctor's notes and discharge summaries. Another provision is the use of Optical Character Recognition or OCR, which can scan medical bills and reports instantly. AI, by combining these two aspects, helps reduce human errors and speed up approvals.

A lot of insurers are also offering provisions like cashless hospitalisation or reimbursement claims, both of which can benefit from AI. The bottom line is that claims that usually took days can now be resolved in a few hours.

But AI hasn’t just benefited policymakers. It also holds quite a few benefits for policyholders. Some of the main benefits that they are expected to experience include:

Faster Claim Approvals, mainly thanks to automation, as most steps are carried out behind the scenes. From claim registration to settlement, it just takes a few clicks.

Personalised Policies, after AI has done its analyses of your health data and suggests the right plans.

Smarter Premiums, made possible by AI, enable insurance to be based on true health indicators and behaviour, not just age or location. Health insurance calculators are a great tool in finding a plan that suits your pocket.

24/7 Support because AI Virtual assistants and AI bots can guide you even in the middle of the night, should you seek it.

Everything from buying a policy to filing a health insurance claim has become truly simpler and more efficient.

It is essential to remember that, like any new technology, AI in health insurance comes with its fair share of challenges. Here is a look at some of them:

Privacy Concerns, because AI will be handling a lot of sensitive health data, require strong encryption and compliance.

Bias in Algorithms, because if the AI has not been designed properly, it can inherit biases from the training data provided to it.

Implementation Costs can be high, which can lead to smaller insurers finding it difficult to afford such upgrades.

Regulation and Oversight Are Necessary, as AI tools must continually evolve in line with the industry's legal and ethical standards.

Insurers must strike a balance between innovation and accountability, as this will enable them to build trust more efficiently.

There is no doubt that the role of AI in the health insurance industry will only grow stronger. This could look like:

Wearables, such as smartwatches, can feed live data to insurers.

Predictive analytics can help alert you to potential health issues before they become serious.

Real-time approval of claims, possibly without paperwork.

Promotion of preventive care, which can help users move towards healthier habits

There is no doubt that the role of AI in the health insurance industry will only grow stronger. This could look like:

Promotion of preventive care, which can help users move towards healthier habits.

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

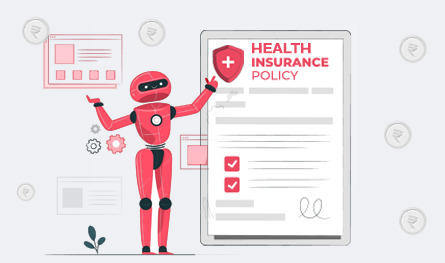

While health insurance is a necessity for everyone, the ‘one-size-fits-all’ approach is not applicable here. While some may be looking to get a policy for their entire family, some may just need single-person coverage. Choosing the right health insurance policy is very important. Not only does it make a difference in the extent of the coverage, but also in your budget. Two of the most popular types of health insurance policies are individual plans and family floater health insurance.

Understanding the key differences between the two will provide you with greater clarity regarding which one to choose. In this guide, we will discuss the differences between these two, their working mechanisms, coverage, and premiums. Read on to make an informed decision when choosing the right health insurance policy.

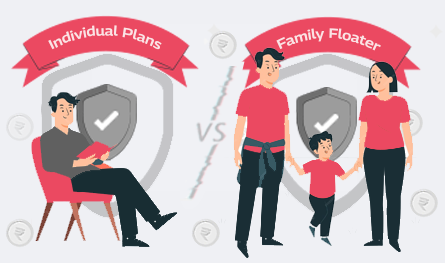

Purchasing health insurance has become a necessity, especially with the news of the double-digit medical inflation being a topic in nearly every discussion. With the introduction of digital platforms, buying a policy has become easier than ever. However, one aspect that remains unclear is how to maximise the benefits of your health insurance. While this may appear overwhelming at first, taking one step at a time and starting with the claim settlement can help ease the decision-making process.

Typically, most health insurance providers offer two types of claim settlement procedures: cashless and reimbursement. Let’s understand the differences between the two and how to choose the right kind of claim settlement for your insurance plan.

Life is often filled with uncertainties over which we have little to no control. The best we can do is to keep ourselves prepared to handle any type of crisis smoothly. Let’s take one step at a time and start by purchasing a robust health insurance plan that promises to cover medical emergencies in exchange for minimal premium payments.

Purchasing health insurance can be overwhelming due to the numerous types of plans and their varying levels of coverage. Let’s learn about the different types of health insurance policies.

There are many issues that the health insurance sector has often struggled with. This includes problems like delayed claim processing, complex paperwork, and fraud detection. However, with AI in the picture, things are changing fast and for the better. With many insurers using AI for health insurance today, they are better able to handle repetitive tasks, streamline claims, and improve customer satisfaction.

The Insurance Regulatory and Development Authority of India (IRDAI) is the primary body that governs and regulates the insurance sector in the country. The body introduces new rules every year to enhance transparency, protect policyholders, and ensure that insurers provide better service.

The changes in the IRDAI health insurance regulations in 2025 are primarily aimed at making health policies more inclusive and seamless for the public. Here is a look at everything new this year.