Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

The Insurance Regulatory and Development Authority of India (IRDAI) is the primary body that governs and regulates the insurance sector in the country. The body introduces new rules every year to enhance transparency, protect policyholders, and ensure that insurers provide better service.

The changes in the IRDAI health insurance regulations in 2025 are primarily aimed at making health policies more inclusive and seamless for the public. Here is a look at everything new this year.

One of the biggest reforms this year is the standardisation of the claim settlement timelines. Under this rule, insurers are mandated to process or reject claims within 30 days of receiving all the necessary documents.

If any delay happens in this aspect, insurers are expected to pay a penalty interest to the policyholder. This ensures that policyholders are not affected by potential late reimbursements during medical emergencies.

IRDAI has officially made it quite clear that mental health is no less important than physical health. With this rule in place, all insurers are required to include coverage for mental illness under their health insurance plans.

Conditions like depression, anxiety, and bipolar disorder are now covered under the new rules, making this a huge step toward promoting mental well-being and removing the stigma around it.

Insurers cannot reject any claims after an individual has held a health policy for eight consecutive years. This cannot be done based on any pre-existing conditions or misinformation. The eight-year time here is called the “moratorium period.”

The rule also rewards loyal policyholders, providing long-term security and greater trust in your insurer.

Many new policyholders can find insurance policy documents confusing. However, now, thanks to the new rules, IRDAI has directed all insurers to use simple, easy-to-understand language.

This helps policyholders understand what is covered under the policy, what is not, and how to make a claim. This rule will also help reduce any potential disputes.

If policyholders want to switch insurers but are concerned about losing their waiting period benefits, a new rule is now in place to help them.

This rule helps you port your health insurance policy without losing the benefits you’ve earned. Such benefits might usually include reduced waiting periods for pre-existing conditions. As a result, policyholders have more flexibility and freedom.

One cannot deny that health technology is advancing fast, and with the rules in place, IRDAI wants the policies to keep up with this advancement.

This is why the new rules specify that treatments like robotic surgeries, oral chemotherapy, and stem cell therapy must now be covered by insurers.

Before these rules came into place, waiting for pre-existing disease or PED coverage used to take close to four years. Now, under the IRDAI rules, this has been reduced to three years or less.

As a result, you gain faster access to coverage for conditions such as diabetes, hypertension, or asthma.

If you are unhappy with your insurance company, the IRDAI rules make it easier to file grievances online, through a 24/7 portal.

IRDAI is also keeping a close eye on companies with frequent complaints to ensure greater accountability and support for policyholders.

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

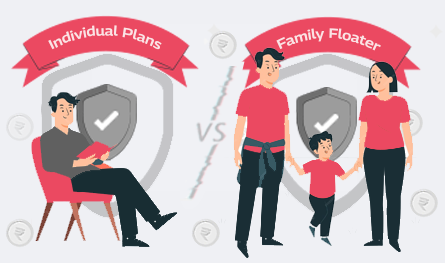

While health insurance is a necessity for everyone, the ‘one-size-fits-all’ approach is not applicable here. While some may be looking to get a policy for their entire family, some may just need single-person coverage. Choosing the right health insurance policy is very important. Not only does it make a difference in the extent of the coverage, but also in your budget. Two of the most popular types of health insurance policies are individual plans and family floater health insurance.

Understanding the key differences between the two will provide you with greater clarity regarding which one to choose. In this guide, we will discuss the differences between these two, their working mechanisms, coverage, and premiums. Read on to make an informed decision when choosing the right health insurance policy.

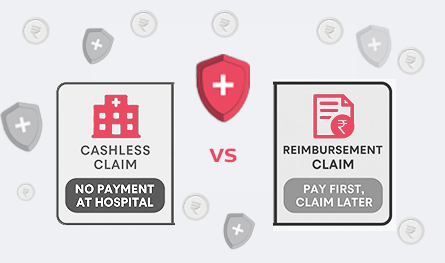

Purchasing health insurance has become a necessity, especially with the news of the double-digit medical inflation being a topic in nearly every discussion. With the introduction of digital platforms, buying a policy has become easier than ever. However, one aspect that remains unclear is how to maximise the benefits of your health insurance. While this may appear overwhelming at first, taking one step at a time and starting with the claim settlement can help ease the decision-making process.

Typically, most health insurance providers offer two types of claim settlement procedures: cashless and reimbursement. Let’s understand the differences between the two and how to choose the right kind of claim settlement for your insurance plan.

Life is often filled with uncertainties over which we have little to no control. The best we can do is to keep ourselves prepared to handle any type of crisis smoothly. Let’s take one step at a time and start by purchasing a robust health insurance plan that promises to cover medical emergencies in exchange for minimal premium payments.

Purchasing health insurance can be overwhelming due to the numerous types of plans and their varying levels of coverage. Let’s learn about the different types of health insurance policies.

There are many issues that the health insurance sector has often struggled with. This includes problems like delayed claim processing, complex paperwork, and fraud detection. However, with AI in the picture, things are changing fast and for the better. With many insurers using AI for health insurance today, they are better able to handle repetitive tasks, streamline claims, and improve customer satisfaction.

The Insurance Regulatory and Development Authority of India (IRDAI) is the primary body that governs and regulates the insurance sector in the country. The body introduces new rules every year to enhance transparency, protect policyholders, and ensure that insurers provide better service.

The changes in the IRDAI health insurance regulations in 2025 are primarily aimed at making health policies more inclusive and seamless for the public. Here is a look at everything new this year.